Blog

BREAKING NEWS! The Reserve Bank of Australia cut the office cash rate to 1%

July 2, 2019

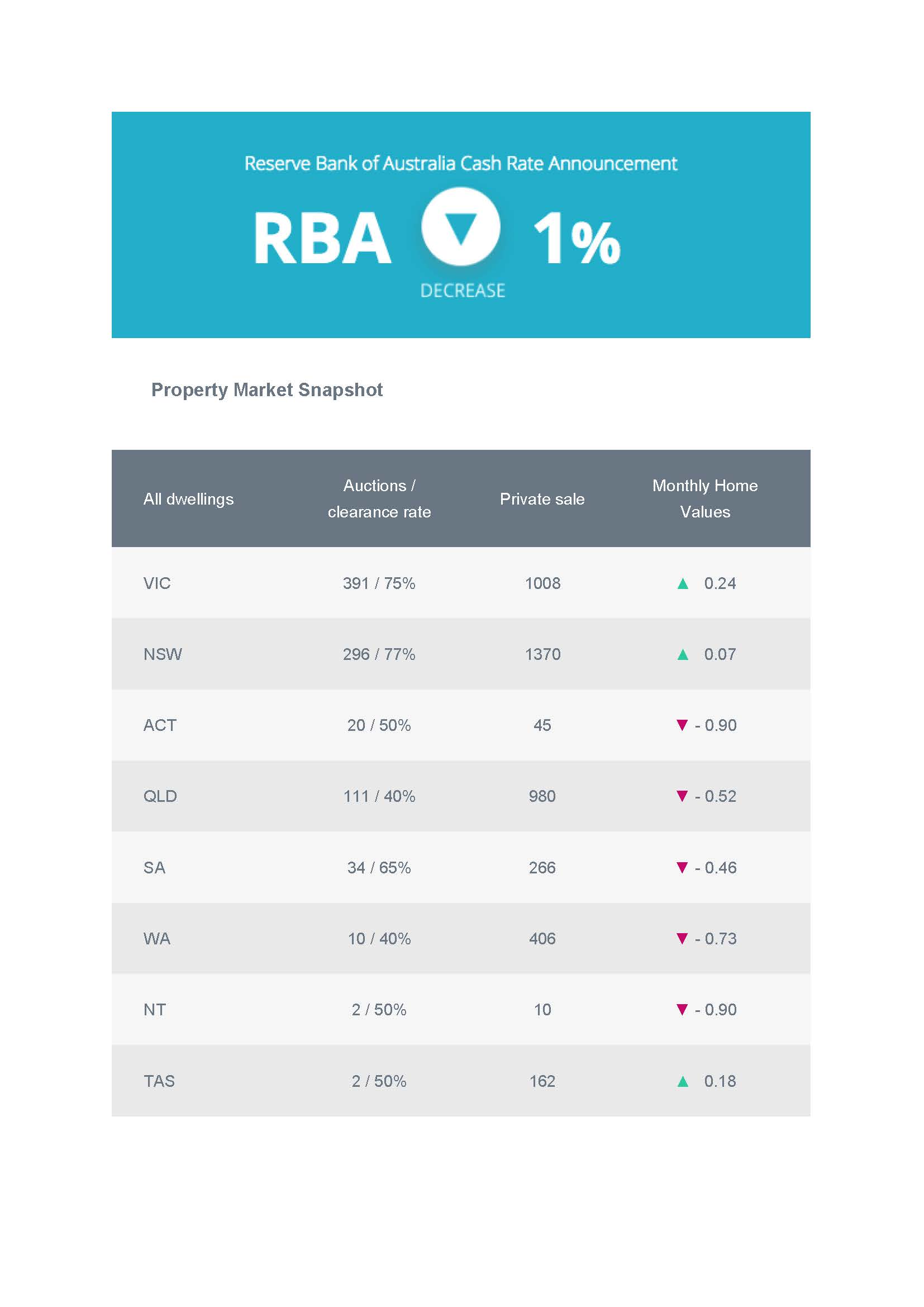

As anticipated by market analysts, the Reserve Bank of Australia (RBA) cut the official cash rate for the second month in a row, bringing it to just 1% p.a. – a new historic low. RBA Governor Philip Lowe said last month “the possibility of lower interest rates remains on the table” and many analysts expect at least one more RBA rate cut by November this year. Meanwhile, most lenders passed on last month’s rate cut to borrowers, causing home loan interest rates to hit their lowest levels since November 2016. On the property market front, CoreLogic reported that home value falls are slowing and auction clearance rates are up, so if you’re looking to buy a home it could be a good time to make a move.

Call us today to find out more.

George M

M: 0491110688

E: george@connected-finance.com.au

Recent Posts

Archives

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- January 2025

- December 2024

- November 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- December 2023

- November 2023

- October 2023

- September 2023

- June 2020

- March 2020

- February 2020

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- February 2019

- December 2018

- December 2017