Blog

Find out the September RBA decision

September 4, 2019

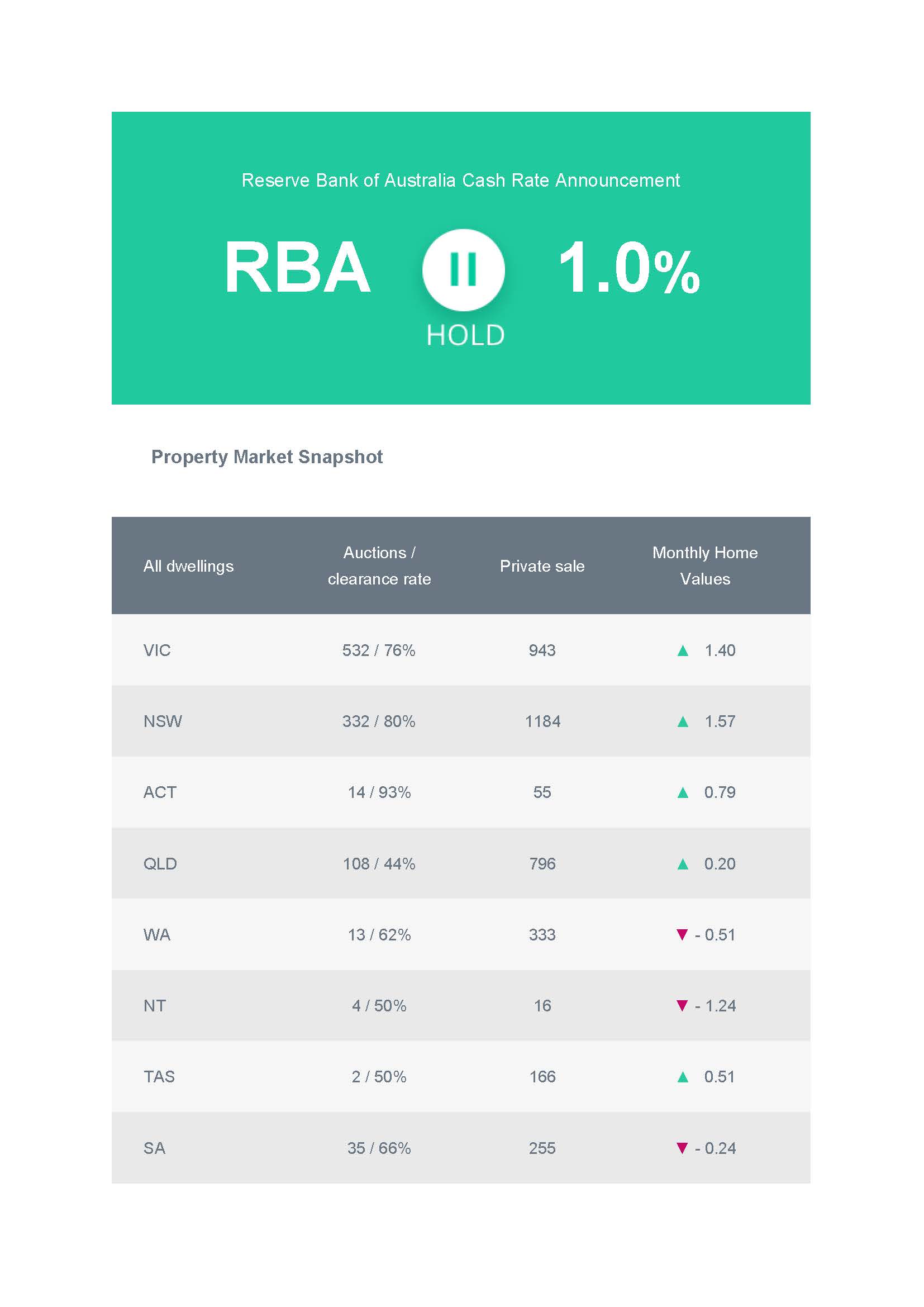

The RBA has kept the official cash rate on hold at 1.0% at its September meeting today.

The RBA Board has hinted an extended period of low interest rates are required to reduce unemployment and achieve inflation targets. Following cash rate cuts in June and July, there’s been speculation about further cuts before the end of the year to stimulate the economy.

Some lenders are now offering some of the lowest mortgage rates in history. Now is the time to review your loan to make sure it’s right for your needs. And if you’re in the market for a spring property purchase, be sure to speak to us about organising pre-approval on your finance.

Call us today to find out more.

George M

M: 0491110688

E: george@connected-finance.com.au

Recent Posts

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- January 2025

- December 2024

- November 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- December 2023

- November 2023

- October 2023

- September 2023

- June 2020

- March 2020

- February 2020

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- February 2019

- December 2018

- December 2017