Blog

How to Spot a Growing Suburb

October 17, 2025

Want to know how to spot a growing suburb before prices take off? While there’s no guaranteed way to predict future capital growth, there are clear indicators that suggest a suburb is on the rise. In today’s property market with […]

Read More

Spring into Property Goals: Renovate, Upsize or Downsize?

September 10, 2025

Spring is a season of fresh starts. Whether that’s family, lifestyle, property or finances. Just like a good spring clean, it’s the perfect time to take a closer look at your current financial and property situation and confirm what is […]

Read More

Using Your Home Equity to Buy an Investment Property

August 13, 2025

Using Equity to Buy an Investment Property If you’ve paid down your mortgage or your property has grown in value, you might be in a position to use your home equity to buy an investment property.This strategy can help you […]

Read More

Can Gambling Affect Your Home Loan Application?

July 15, 2025

Can Gambling Affect Your Home Loan Application? If you’re planning to buy a home, it’s important to know that your gambling habits can affect your chances of loan approval. When applying for a mortgage, lenders assess your full financial situation—and […]

Read More

Mortgage Broker Frequently Asked Questions | Connected Finance

June 11, 2025

Top Mortgage Questions Answered by Connected Finance When you’re buying a home, it’s natural to have questions—especially around loans, deposits, and interest rates. In this guide, we answer the top mortgage broker frequently asked questions we hear at Connected Finance, […]

Read More

Negative Gearing Explained

May 15, 2025

Negative Gearing Explained Australia: What Investors Need to Know Negative gearing explained Australia – it’s a phrase you might have heard but what does it really mean, and how does it affect you as an investor? What is Negative Gearing? […]

Read More

CBA Updates How It Assesses Student Debt (HECS/HELP) for Home & Investment Loans

April 14, 2025

CBA HELP debt assessment home loan changes are now officially in place—and they could make a big difference to your borrowing power. Commonwealth Bank (CBA), Australia’s largest lender, has introduced new ways to assess HELP (Higher Education Loan Program) debt […]

Read More

How a Redraw Facility Can Help You

March 19, 2025

How a Redraw Facility Can Help You and Your Home Loan Managing your home loan wisely can save you money and provide greater financial flexibility. Moreover, a redraw facility is an excellent way to reduce interest costs while still having […]

Read More

Exposing what home buyers REALLY think about working with a mortgage broker

January 8, 2025

Buying a home – whether it’s your first or your tenth – is a huge milestone, and working with the right mortgage broker can make or break the experience. At Connected Finance, we pride ourselves on finding the best home […]

Read More

Why choosing a mortgage broker over the bank could save you thousands

December 9, 2024

When it comes to getting a home loan, most people face the same big question: should you go to a mortgage broker or stick with your bank? It’s a decision that can feel overwhelming, especially with so many opinions competing […]

Read More

Everything you need to prepare for your first mortgage broker meeting

November 6, 2024

So, you’re gearing up for your first ever mortgage broker meeting. But as the big day gets closer, you’re not sure whether to feel excited or nervous. We’re here to assure you, there’s nothing to worry about. A mortgage broker […]

Read More

Buying a home at auction: Everything first-home buyers need to know

September 30, 2024

Buying a home at auction can be a daunting experience. With bids flying from every direction, intense pressure from the auctioneer and mounting competition from fellow bidders, your stress levels will be through the roof. If you’re ready to buy […]

Read More

Credit Reports 101: Everything You Need To Know For Your Home-Buying Journey

September 3, 2024

What is a Credit Report? Your credit report is like a financial report card. It’s a snapshot of how you’ve managed credit and debt over time. Like in school, this report reflects your history, including your highs and lows. It […]

Read More

Navigating Construction Loans: A Guide for First Home Buyers

July 31, 2024

Buying your first home is an exciting journey, and if you’re considering building or renovating, understanding construction loans is crucial. Unlike regular home loans, construction loans are tailored for financing the building of a new home or major renovations. Here’s […]

Read More

New Financial Year, New Goals: Empower Your Financial Future

July 2, 2024

With the new financial year upon us, now is the perfect time to reassess and set fresh financial goals. Whether you’re aiming to save for your first home, cut back on expenses, or simply understand your financial position better, we’ve […]

Read More

Get your finances sorted for EOFY

June 5, 2024

EOFY is just around the corner (gasp!). If that statement feels like a jumpscare, you’re probably not prepared. It pays to keep on top of your finances throughout the year so that EOFY goes smoothly when it inevitably rolls around. […]

Read More

Federal Budget 2024: What It Means for Homeowners and Aspiring Buyers

May 21, 2024

Last week, the Australian Federal Government delivered the 2024 Federal Budget. Here’s everything you need to know as a homeowner or aspiring buyer: Tax Cuts Tax cuts set to roll out from July this year were introduced, building upon previous […]

Read More

Turning Dreams into Keys: First Home Buyer Rebates and Your Path to Homeownership

April 2, 2024

To borrow or not to borrow? That’s the question on many aspiring first-home buyers’ lips right now. We can’t blame you, either. It can seem like there’s something new shaking up the market every other week. It’s easy to feel […]

Read More

Your Fixed Mortgage Rate is Expiring. Now What? A Look at Refinancing

March 1, 2024

So, your fixed-rate mortgage is about to hit its expiration date. What next? It’s like that moment of anticipation when you’ve been waiting in the Taylor Swift Ticketek queue, expecting something (anything) good to happen—except, in this case, it’s all […]

Read More

3 Reasons Why Rentvesting Beats Buying for Building Long-Term Wealth

February 2, 2024

We’re not big fans of financial jargon but we’ll make an exception for this one word: rentvesting. It’s an investing term you’ll be seeing a lot more of this year, so now’s the perfect time to learn all about it. […]

Read More

Money Mindset – How to Make Your Money Work for You

December 22, 2023

So, your New Year’s resolution is to buy a home in 2024. But how will you make that happen? With rates at a 12-year high, first home buyers are facing increased mortgage costs and higher monthly repayments. Though this might […]

Read More

First Home Buyers – Home Ownership is Closer Than You Think

November 30, 2023

Becoming a first home buyer might feel like a pipe dream right now. With the media sprouting doom and gloom about mortgage cliffs and rising interest rates it’s easy to have a bleak outlook. But if you take a closer […]

Read More

Everything you need to know about buying your first home with the help of a mortgage broker

October 31, 2023

Every Aussie dreams of owning their own home. But with the ongoing cost of living crisis, it’s easy to feel disheartened by the media’s gloomy portrayal of the housing market. Add to that the complex and confusing jargon banks and […]

Read More

Essential Guide to Refinancing Your Mortgage

September 29, 2023

With the mortgage cliff on the horizon, understanding how to refinance your mortgage is more important than ever before. In 2023 and 2024, over a million borrowers will come to the end of their roughly 2% fixed-rate home loan terms, […]

Read More

Why You Should Use a Mortgage Broker

September 4, 2023

Whether you’re looking to buy your first home or planning on refinancing your existing home loan, you might be wondering whether you should engage the help of a mortgage broker and how the process works. In this article, we’ll explain […]

Read More

Homebuyers grant: Full details of $25k HomeBuilder scheme announced

June 4, 2020

On Thursday 4th June 2020 the Australian government announced the homebuilder stimulus scheme, offering $25,000 grants for new homes or substantial renovations. But just who is eligible for the cash and what are the strings attached? Who qualifies? To be eligible, you must: […]

Read More

Key Bank Contact Details and Links for COVID-19 Hardship Support

March 26, 2020

AMP Email: AB_Credit_Services_Hardship@ampbanking.com.au 133030 ANZ https://www.anz.com.au/promo/covid-19/ Bankwest https://www.bankwest.com.au/help/coronavirus-support#content-btc-c?promocode=edm5979&cid=edm5979 1300 134 107 CBA https://www.commbank.com.au/latest/coronavirus.html?ei=hp-ban-cvp-default-coronavirus Connective Home Loans https://www.connectivehomeloans.com.au/contact-us/ 1300 543 558 | ING 1300 656 226 Macquarie Bank https://www.macquarie.com/au/personal/coronavirus ME Bank https://www.mebank.com.au/support/pausing-your-home-loan-repayments/ 13 15 […]

Read More

Exciting news for first home buyers!

February 13, 2020

There’s nothing quite as exciting as receiving a shiny set of keys to your very own home. The thrill of knowing it’s all yours. The freedom to be able to do what you like with it. Nothing compares! If you’re […]

Read More

4 habits of successful property investors

October 10, 2019

Australians love investing in property, and it’s no wonder why. The property market offers a myriad of opportunities to potentially grow wealth, irrespective of one’s professional background or skillset. However, there are certain habits that successful property investors often have […]

Read More

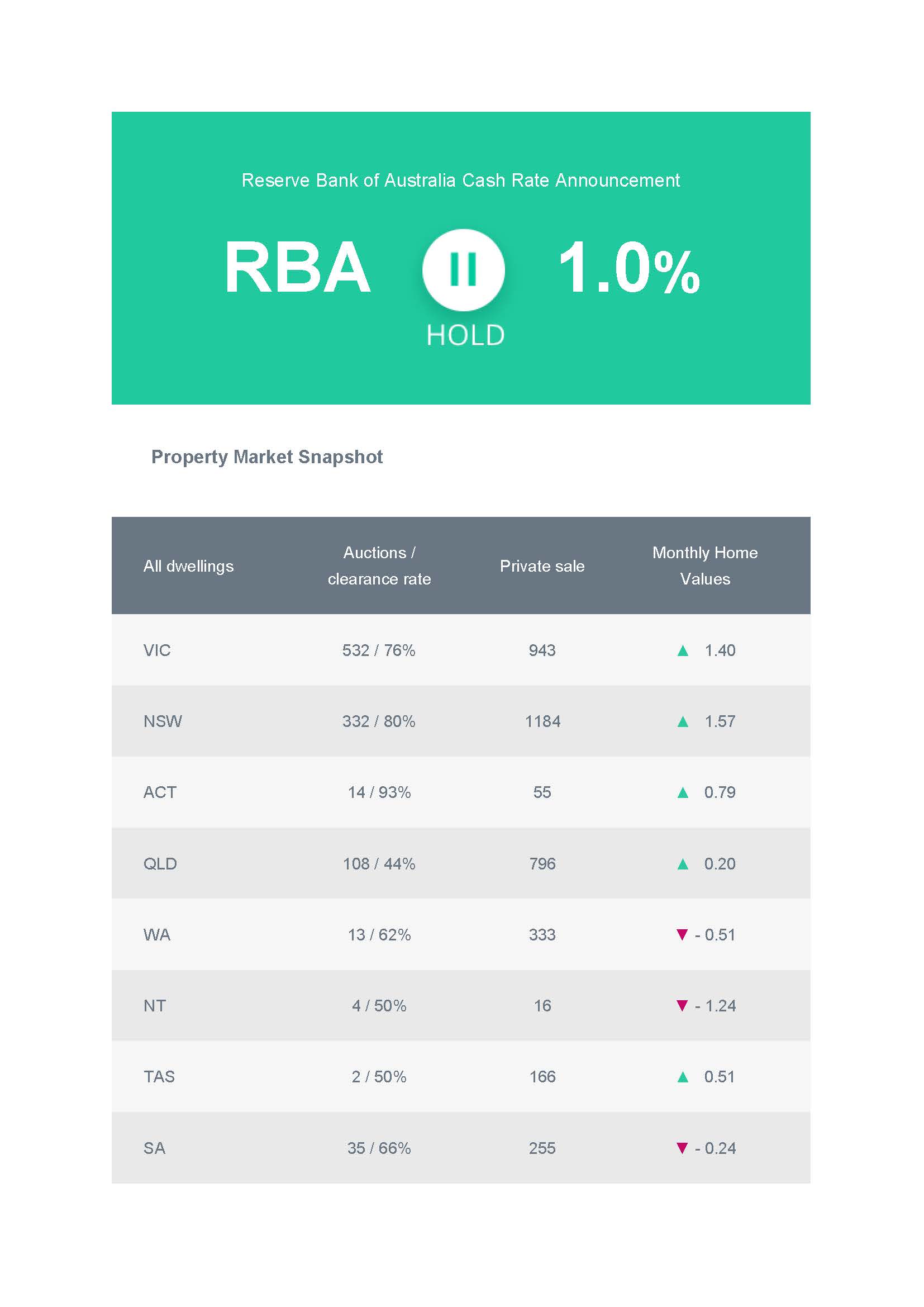

Find out the September RBA decision

September 4, 2019

The RBA has kept the official cash rate on hold at 1.0% at its September meeting today. The RBA Board has hinted an extended period of low interest rates are required to reduce unemployment and achieve inflation targets. Following cash […]

Read More

How to prepare for the Spring property season

September 3, 2019

The busy Spring property season is upon us and you know what that means? Whether you’re planning to buy or sell, NOW is the time to start getting organised. Here’s how. Tips if you’re planning to BUY this Spring: Get […]

Read More

Four signs it may be time to refinance

September 3, 2019

Do you know what happened after the Reserve Bank cut the cash rate in June? Tens of thousands of Aussies took the Treasurer’s advice to “shop around and get the best possible deal”. Mortgage brokers around the country have recorded spikes in […]

Read More

Everything you need to know about rentvesting

September 3, 2019

Rentvesting has become increasingly popular in recent times. Last year, research from the Property Investment Professionals of Australia (PIPA) found that one third of first-time buyers opted to become ‘rentvestors’, rather than homeowners. Here’s what you need to know before deciding whether […]

Read More

Can you exit an off-the-plan purchase?

September 3, 2019

Are you considering buying a property off the plan? It’s a great idea on paper. You get a brand-new home and a nice chunk of time to save up for it. Combine that with the possibility of stamp duty concessions […]

Read More

Why first home buyers should start small

September 3, 2019

When it comes to buying a home, bigger is better, right? Maybe not. All over the world, people are changing their attitude to the size of home they live in. This is particularly true amongst millennials, and if you’re looking […]

Read More

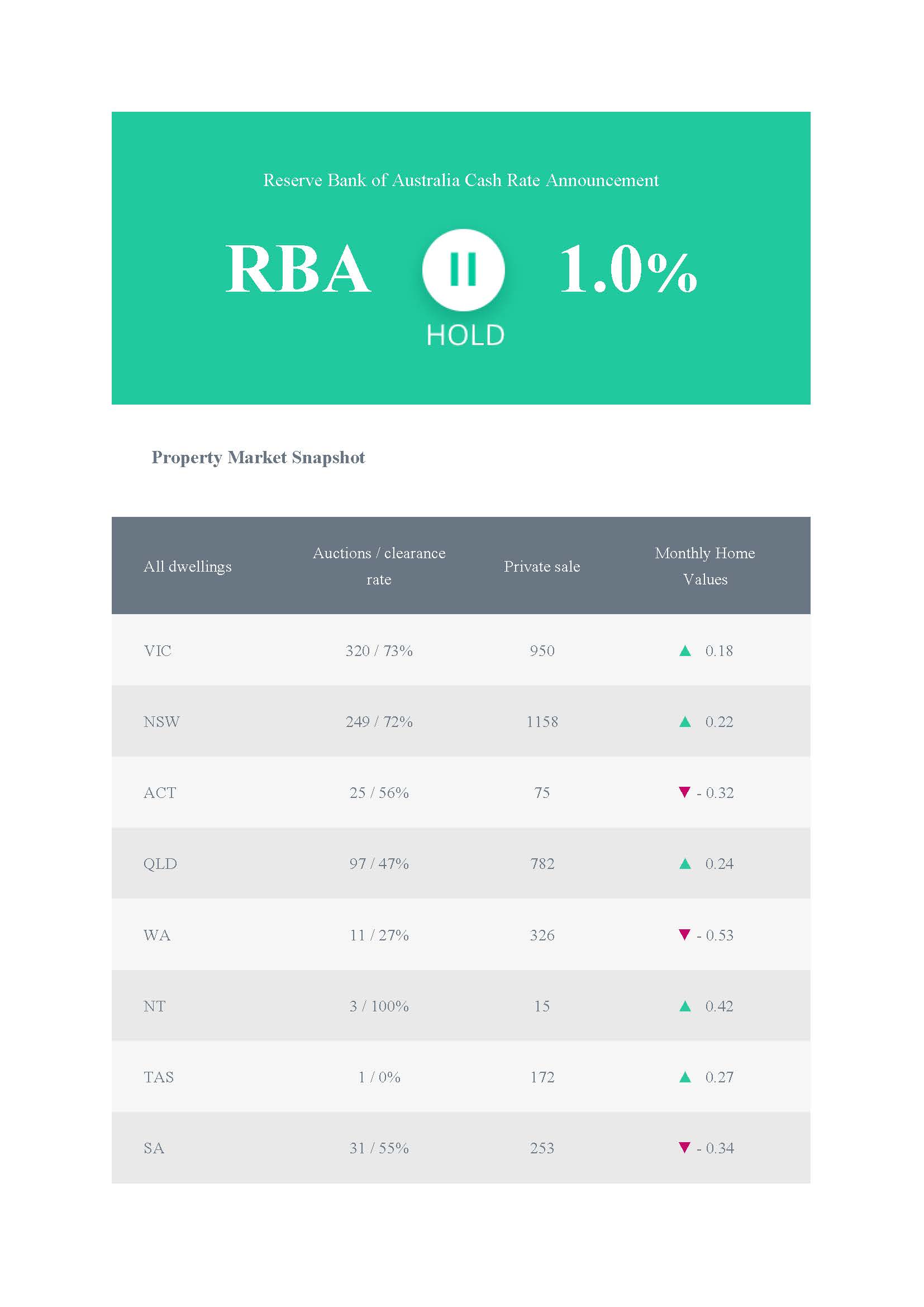

Find out the August RBA decision

August 6, 2019

The RBA has decided to keep the official cash rate on hold at 1.0%. The cash rate remains at its lowest level in Australian history. The RBA’s recent decisions have prompted plenty of movement in interest rates amongst the big […]

Read More

Need a loan for your next home- what is bridging finance, how does it work, pros / cons and other options…

July 28, 2019

Whether you’re upsizing, downsizing or just moving to a home in a new location, no doubt things have changed since buying your last home. This article explains the finance options available when you’re moving on to your next home. We […]

Read More

Why your broker is your friend for life

July 28, 2019

How you use your income and available credit can make a huge difference to your lifestyle, so it’s very important to get it right. That means getting reliable, ongoing advice and support from a professional credit advisor/broker you know and […]

Read More

How to identify the most profitable target market for your property

July 28, 2019

If you’re looking to rent out or sell your home, identifying the right market for your property and making it appeal to them, will help you to maximise your profits. So how do you go about it? Use these tips […]

Read More

Tips to build your own home

July 28, 2019

Here’s an overview of what’s involved if you’re wanting to build your own home for the first time. What’s your budget? The first step to building a home is deciding what you can afford to spend. When buying a home […]

Read More

How do your living expenses affect your borrowing power?

July 28, 2019

You may be surprised to discover that how much you spend on day-to-day living expenses can considerably reduce the amount you are eligible to borrow, even if you are a high-income earner. So, if you’re planning to buy a home, […]

Read More

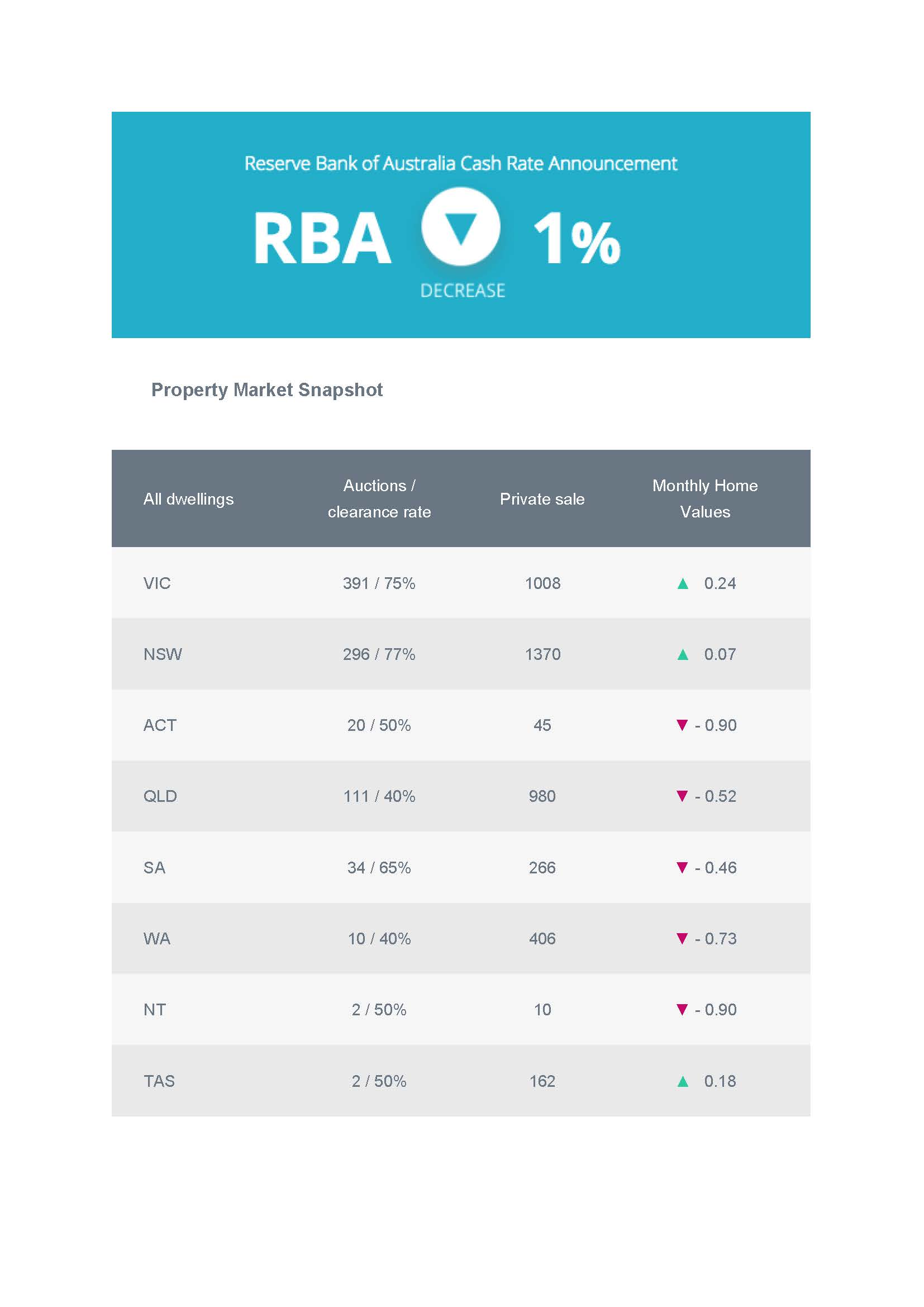

BREAKING NEWS! The Reserve Bank of Australia cut the office cash rate to 1%

July 2, 2019

As anticipated by market analysts, the Reserve Bank of Australia (RBA) cut the official cash rate for the second month in a row, bringing it to just 1% p.a. – a new historic low. RBA Governor Philip Lowe said last […]

Read More

How to compare home loans and features

June 30, 2019

Which home loan is right for you? How can you tell when there’s so many different lenders, loan types and features to choose from? How can you compare loans properly when you’re not sure what you should be comparing? Finding […]

Read More

5 common mistakes of first home buyers

June 30, 2019

Getting ready to buy your first home? As your mortgage broker, we’re here to help you every step of the way. It’s an exciting time and it’s easy to make mistakes. Here are 5 common mistakes that you should try […]

Read More

How to make a pre-auction offer

June 30, 2019

With auction clearance rates slipping below 50% in some markets right now, vendors are much more open to a pre-auction offer. You’ll also find more vendors choosing a private sale over an auction because it allows them to hold out […]

Read More

How to estimate the rental return on an investment property

June 30, 2019

No matter what investment strategy you use, calculating the potential rental return on an investment property is a key step in the purchasing decision process. The rental yield is an important indicator of how a property is likely to perform […]

Read More

Is your Borrowing Capacity about to increase!!!!????

May 22, 2019

APRA- Australian Prudential Regulation Authority is an independent statutory authority that supervises institutions across banking, insurance and superannuation and promotes financial system stability in Australia. APRA’s newly announced proposal to allow banks to set their own serviceability floors when assessing […]

Read More

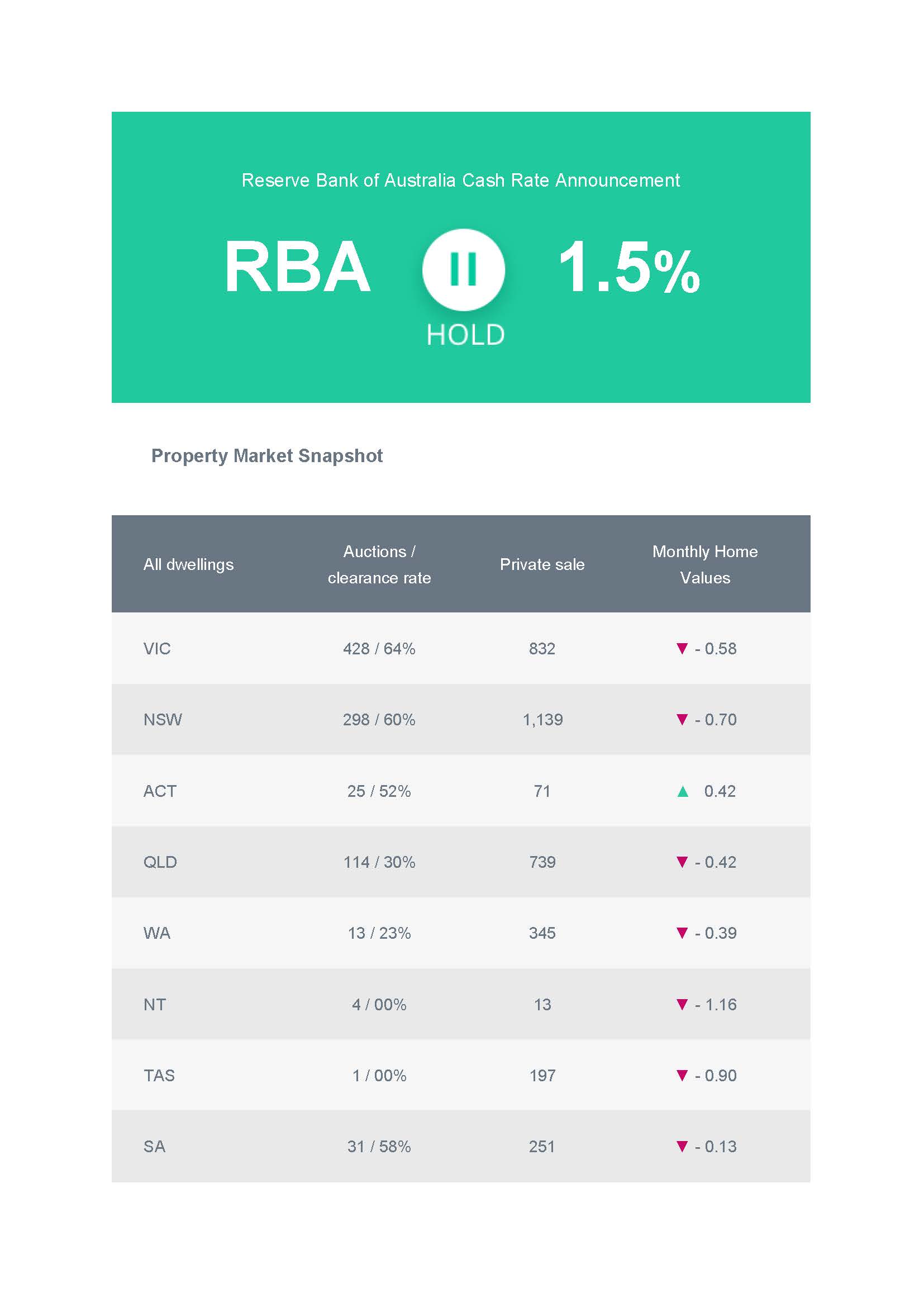

Find out the May RBA decision

May 7, 2019

At its May meeting today, the Reserve Bank of Australia (RBA) decided to keep the official cash rate at 1.5% – despite speculation from economic analysts that there may be at least one, or possibly two RBA rate cuts by […]

Read More

THE HIDDEN VALUE OF MORTGAGE BROKERS

February 11, 2019

In light of the recent final report of the Financial Services Royal Commission, there’s been a lot of really positive and supportive commentary about mortgage brokers and the value that they bring to Australian home owners. Much of the commentary […]

Read More

How would an RBA rate rise affect you?

December 14, 2018

It’s been nearly eight years since the Reserve Bank of Australia (RBA) last raised the country’s official cash rate. Interest rates have been at historical lows for quite some time and as a homeowner, you may never have experienced an […]

Read More

Unique Home Decoration Ideas For Christmas

December 19, 2017

Christmas is such a special time of year! You can feel the magic in the air at shopping centres as the decorations come out, or when you’re driving around and notice people transforming their homes into a wonderland of lights.If […]

Read MoreRecent Posts

Archives

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- January 2025

- December 2024

- November 2024

- September 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- December 2023

- November 2023

- October 2023

- September 2023

- June 2020

- March 2020

- February 2020

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- February 2019

- December 2018

- December 2017